Search

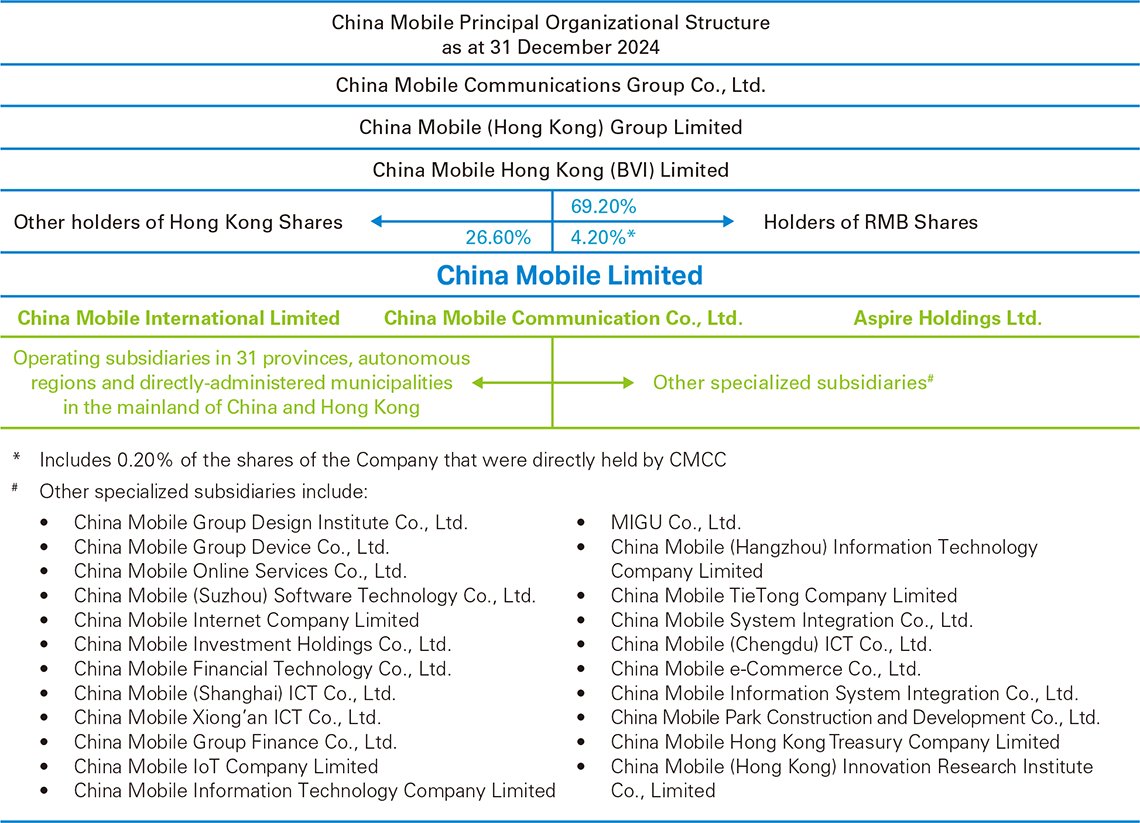

China Mobile Limited (the “Company”, and together with its subsidiaries, the “Group”) was incorporated in Hong Kong on 3 September 1997. The shares of the Company were listed on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”) on 23 October 1997 and were admitted as a constituent stock of the Hang Seng Index in Hong Kong on 27 January 1998. On 5 January 2022, the Company’s RMB ordinary shares (“RMB Shares” or “A Shares”) were listed on the Main Board of the Shanghai Stock Exchange (“SSE”). On 19 June 2023, a RMB counter was added for the trading of shares in the Company listed on the Main Board of the Hong Kong Stock Exchange (the “Hong Kong Shares”).

As the leading ICT services provider in the mainland of China, the Group provides communications and information services in all 31 provinces, autonomous regions and directly-administered municipalities throughout the mainland of China and in Hong Kong SAR, and boasts a world-class telecommunications and information operator with the world’s largest network and customer base, a leading position in profitability, brand value and market value ranking. Its businesses primarily consist of voice, data, broadband, dedicated lines, IDC, cloud computing, IoT and other services in the Customer, Home, Business and New (“CHBN”) markets. As of 30 June 2025, the Group’s total number of employees reached 450,000, and had a total of 1,005 million mobile customers and 323 million wireline broadband customers. For the first half of 2025, the Group’s operating revenue reached RMB543.8 billion.

The Company’s ultimate controlling shareholder is China Mobile Communications Group Co., Ltd. (“CMCC”), which, as of 30 June 2025, directly and indirectly held approximately 69.09% of the total number of issued shares of the Company. The remaining approximately 30.91% was held by public investors. Currently, the Company’s corporate credit ratings are equivalent to China’s sovereign credit ratings, namely, A+/Outlook Stable from Standard & Poor’s and A1/Outlook Negative from Moody’s.

About China Mobile

About China Mobile